1. Octanol Overview

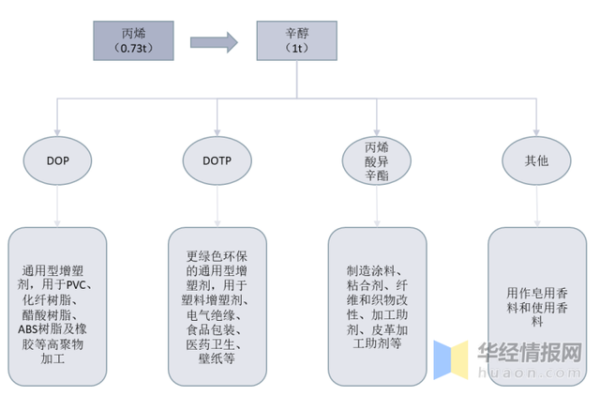

Octanol, also known as n-octanol, is an organic compound, a colorless transparent oily liquid with a strong oily and citrusy smell, immiscible with water, but miscible with ethanol, ether, and chloroform. From the perspective of product use, octanol is mainly used to prepare dioctyl phthalate (DOP), dioctyl terephthalate (DOTP), octyl acrylate, dioctyl azelate, and dioctyl sebacate Esters and other products; in addition, it can also be used as solvents, plasticizers, antifreeze agents, lubricants, extractants, dispersants, stabilizers, spices and other products for refined oil, plastics, coatings, printing and dyeing, food processing, cosmetics, etc. field.

Octanol industry chain

Source of information: Compilation of public information

2. Development status of octanol industry

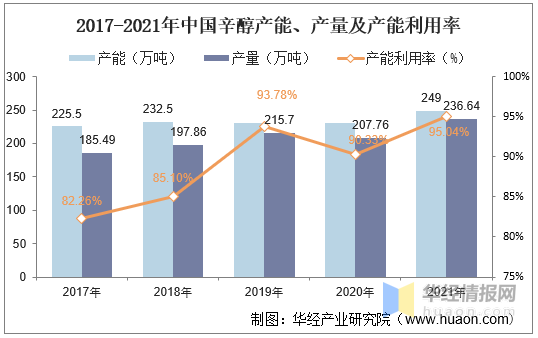

From the perspective of the supply side, the domestic production capacity has remained basically stable, and the overall output has maintained a steady increase. According to statistics, in 2021, the production capacity of my country’s octanol industry will be 2.49 million tons, and the output will be 2.3664 million tons, a year-on-year increase of 13.9%, and the capacity utilization rate will be 95.04%.

China’s Octanol Capacity, Output and Capacity Utilization Rate, 2017-2021

Source of information: Compilation of public information

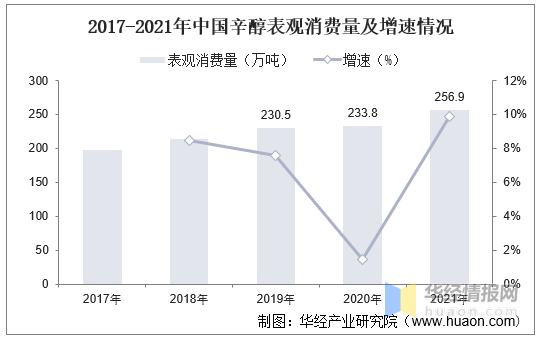

From the perspective of the demand side, the apparent consumption of octanol shows an increasing trend from 2017 to 2021. In 2020, due to the impact of the new crown epidemic, the growth rate is low, only 1.43%, and the growth rate in the rest of the years is above 8%. In 2021, the apparent consumption of octanol will be 2.569 million tons, a year-on-year increase of 9.9%.

Apparent consumption and growth rate of octanol in China from 2017 to 2021

Source of information: Compilation of public information

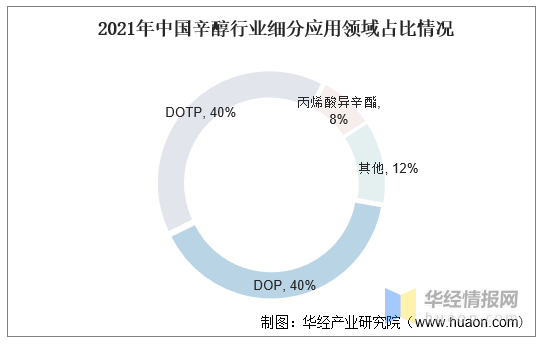

The consumption of octanol is concentrated in plasticizers such as dioctyl phthalate (DOP) and dioctyl terephthalate (DOTP). DOTP does not contain phthalates, and is an excellent environmentally friendly plasticizer. It is not included in the 16 types of phthalate-containing plasticizers restricted by the EU and other countries. DOTP has good electrical and thermal properties, and can replace DOP in PVC plastic electrical wire sheaths. It has excellent compatibility and plays a role in improving the hardness and deformability of products. DOTP can be used in the production of artificial leather film, plasticization of acrylonitrile derivatives, polyvinyl butyral, rubber, nitrocellulose, etc., and high-quality lubrication of paints, coatings and precision instruments for furniture and interior decoration It is a kind of plasticizer with wide application, such as additive or lubricating additive, nitro varnish additive, paper softener, polyester amide biaxially stretched film, film-plastic handicraft, plasma storage bag, etc.

Proportion of Subdivided Application Fields of China’s Octanol Industry in 2021

Source of information: Compilation of public information

Related report: ” 2021-2026 China Octanol Market Supply and Demand Status and Investment Strategy Research Report ” issued by Huajing Industry Research Institute

3. Current status of import and export of n-octanol industry

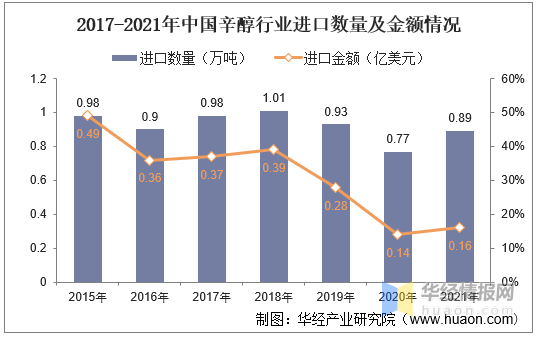

The customs code of “n-octanol” is “29051610”. From the perspective of import and export, my country is a major importer of octanol, but in recent years, as domestic octanol plants have been built and put into operation, the import volume has gradually shown a downward trend, and the import volume will rebound in 2021. According to statistics, in 2021, my country’s octanol import volume will be 8,900 tons, and the import value will be 16 million US dollars.

Import Quantity and Amount of Octanol Industry in China from 2017 to 2021

Source: General Administration of Customs, compiled by Huajing Industry Research Institute

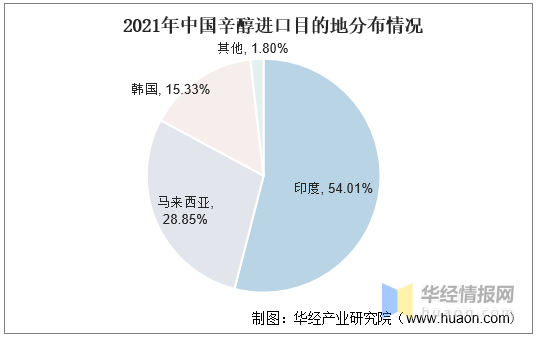

Judging from the distribution of import destinations, my country’s octanol is mainly imported from Asia, which accounts for 99.9% of imports. Specifically, India accounted for 54.01%, Malaysia accounted for 28.85%, and South Korea accounted for 15.33%.

Distribution of Octanol Import Destinations in China in 2021

Source: General Administration of Customs, compiled by Huajing Industry Research Institute

4. Competitive landscape of octanol industry

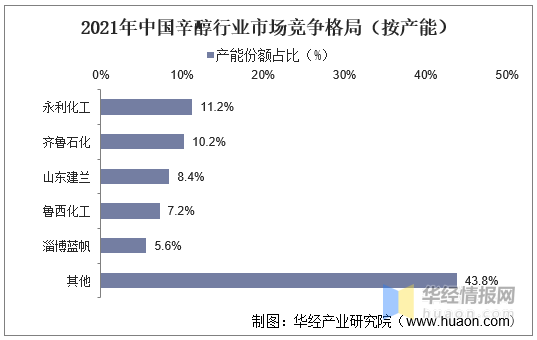

From the perspective of industry competition pattern (according to production capacity), the concentration of production capacity in the octanol industry is relatively high, and the five companies with the largest production capacity account for nearly 50% of the total production capacity of the industry. According to statistics, the CR5 production capacity of China’s octanol industry in 2021 is: Yongli Chemical (280,000 tons, accounting for 11.2%), Qilu Petrochemical (255,000 tons, accounting for 10.2%), Shandong Jianlan (210,000 tons, accounting for 8.4%) %), Luxi Chemical (180,000 tons, accounting for 7.2%), Zibo Lanfan (140,000 tons, accounting for 5.6%).

Market competition pattern of China’s octanol industry in 2021 (by capacity)

Source of information: Compilation of public information

5. Future development trend of octanol industry

1. The price fell back to a reasonable range

In 2021, the price of octanol has experienced ups and downs, and the price has gradually increased recently. On February 12, 2022, the price of octanol was 14,875 yuan/ton, and the price difference was 7,891 yuan/ton, which was higher than the historical average.

2. The increase in DOTP output will drive the demand for octanol

In the downstream demand structure of octanol, DOTP and DOP respectively account for 40% of the market. In 2021, the apparent consumption of octanol will be 2.569 million tons, a year-on-year increase of 9.9%. Among them, the output of DOPT, a downstream product, will increase significantly, which will stimulate the demand for octanol.

3. In recent years, the supply of octanol is relatively short

In June 2022, Ningxia Baichuan is expected to put into production 78,000 tons of octanol. In 2023, Huachang Chemical is expected to put into production 300,000 tons of polyols. Satellite Petrochemical is expected to put into production 800,000 tons of butanol in 2024. From 2022 to 2023, it is estimated that 620,000 tons of DOTP will be put into production in China, and each ton of DOTP will consume 0.685 tons of octanol, which is expected to form a demand for about 424,700 tons of octanol. Limited by capacity growth, it is expected that the operating rate of octanol will remain at a relatively high level in the next two years, and the supply will be relatively short. After satellite petrochemical butanol is put into production in 2024, the supply and demand pattern will be improved.