Comprehensive the latest major shipping index SCFI, NCFI index have stopped falling return orders almost 4 consecutive weeks of small increases in different lines of freight price trend divergence European and American airlines continue to decline; South America, Australia and New Zealand, Southeast Asia, the Middle East airlines rose significantly; WCI major airline indices remain stable us routes have a downward trend European routes have been relatively stable in recent weeks; FBX Global Composite Average index has declined continuously since March 11. What is particularly noteworthy is that the US line is in a declining trend except for small fluctuations in a few weeks. The European and Mediterranean line is stable and has a small increase in the last five weeks.

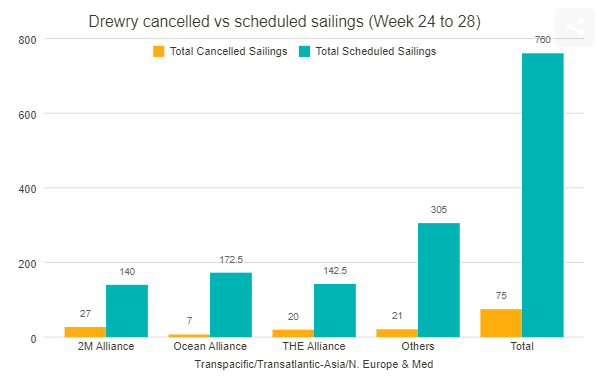

WCI: According to Drury’s latest data, 75 of approximately 760 scheduled sailings will be cancelled in week 24 to 28 (June 13 to July 17) on major trans-Pacific, trans-Atlantic, Asia-Northern Europe and Asia-Mediterranean routes. The world’s three major shipping alliances have cancelled a total of 54 sailings. Among them, 2M Alliance has the largest number of cancellations with 27 flights. THE alliance reached 20 voyages. The fewest sea Alliance cancels 7 voyages; Seventy-five percent of this traffic takes place on trans-Pacific eastbound routes mainly to the Western United States.

SCFI: Last week, China’s export container transport market continued to stabilize the trend of freight prices on different lines showed divergence. On June 10th, the Shanghai Composite freight index of export containers released by Shanghai Shipping Exchange was 4233.31 points, up 0.6% compared with the previous period. Although the SCFI index rose for the fourth straight week, major European and American routes continued to fall.

European airlines: Affected by the epidemic and the russia-Ukraine conflict, the future economic recovery in Europe will face the double test of high inflation and energy crisis. Current transport market continues to maintain stable market freight rate drops slightly. Mediterranean line spot market booking space prices fell slightly.

North American airlines: The epidemic will still be a serious drag on the Us economic recovery inflation is still high, the US economy is facing stagflation. Last week transport demand to maintain stable supply and demand fundamentals balance market freight prices continue to fall.

NCFI: The Ningbo Export Container Freight Rate Index (NCFI) published by ningbo Shipping Exchange from June 4th to June 10th closed at 3540.7 points, up 0.1% from last week. The index rose on 11 out of 21 routes and fell on 10. Among the major ports along the Maritime Silk Road, seven saw their freight rates rise and nine saw their freight rates fall.

Middle East routes: routes are still relatively tight shipping rates after the first few weeks of continuous increases June 10, the latest spot market booking prices overall stable. The Middle East Airlines Index rose 0.5% to 3272.5.

In addition, the east Route of South America fluctuates greatly: the market transportation demand gradually recovers, and the shipping space of some voyages begins to tighten up, and the price of booking space in the spot market increases greatly. The freight index of South America east route was 4143.2 points, up 9.3% from last week.

FBX: The latest Freightos Baltic Index FBX showed a 5% drop in trans-Pacific freight rates from Asia to the West on June 10. Freight rates from Asia to the eastern United States fell 6 percent.

The European and Mediterranean routes have been stable for the last 5 weeks with a slight increase.

The European and Mediterranean routes have been stable for the last 5 weeks with a slight increase.

Meanwhile, demand for eastbound trans-Pacific routes remains low. Labor negotiations between the International Terminals and Warehouses Union (ILWU) and the Pacific Maritime Association (PMA) are still ongoing. It is uncertain whether there will be a cargo surge and a peak season. Prices are still high compared to pre-pandemic markets and prices are falling in several key market segments, particularly for services to western American ports.

European demand is picking up, but it is still suffering from the widespread impact of severe congestion at European ports that has slowed the return of cargo vessels to Asian ports, delayed shipping schedules and increased air traffic. The market is expected to strengthen in the third quarter and peak in the summer as Production resumes in Shanghai. But there is still a lot of uncertainty about macro factors such as the conflict between Russia and Ukraine, high inflation across Europe and consumer confidence. Prices are expected to rise due to the current relative shortage of space.